2026: Crypto Regulation Finally Grows Up and Gets Serious!

Okay, friends, let's talk crypto. I know, I know, it can feel like a rollercoaster, but what if I told you 2026 is shaping up to be the year crypto regulation finally finds its footing? We're not talking about stifling innovation, but about creating a framework for sustainable growth, trust, and, dare I say, a little bit of sanity in the digital asset space. It's about time, right?

The Wild West to Regulated Territory

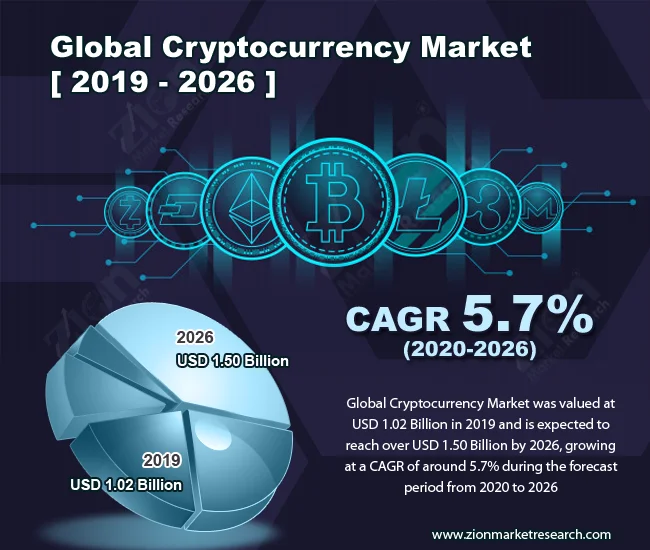

Think of it like this: crypto, for the longest time, has been like the Wild West – full of opportunity, sure, but also rife with risk and, let's be honest, a few too many cowboys and bandits. What we're seeing now, in late 2025 and heading into 2026, is like the arrival of the sheriffs, bringing order, accountability, and a sense of security. The TRM Labs report on global crypto policy paints a clear picture: stablecoins are taking center stage, institutional adoption is being fueled by regulatory clarity, and there's a global push for consistency. This isn't just about rules; it's about building a foundation for crypto to truly become a mainstream force in finance.

Drivers of Regulatory Change

And what's driving this change? Well, a few things. First, the stablecoin explosion. These digital assets, pegged to stable currencies like the US dollar, have shown real potential as mediums of exchange on public blockchains. But with that potential comes responsibility. Regulators around the world, from the US with the GENIUS Act to the EU with MiCA, are recognizing the need for bespoke frameworks to govern their issuance, reserves, and redemption.

Industry Maturation and the Role of Regulation

But here's the thing: this isn't just about governments cracking down. It's also about the industry maturing. Financial institutions are moving in, announcing new digital asset initiatives in jurisdictions with clear, innovation-friendly regulations. They understand that compliance and risk management are paramount, and that strong regulatory standing is key to partnerships. As the TRM Labs report highlights, VASPs (Virtual Asset Service Providers) in regulated environments have significantly lower rates of illicit activity. Regulation isn't a burden; it's a shield, protecting the ecosystem from bad actors and fostering trust among users.

Think about it: what good is technological innovation if it's constantly undermined by scams, hacks, and regulatory uncertainty? We need a system where responsible actors can thrive, where innovation can flourish, and where consumers can participate with confidence. That's what this regulatory wave promises, and that's why I'm so excited about 2026.

Global Regulatory Developments

What does this all mean practically? Well, a lot, depending on where you are in the world. The report highlights key developments in 30 jurisdictions, representing over 70% of global crypto exposure. In the US, we're seeing landmark progress with the GENIUS Act and coordinated agency action under the Trump administration. In Europe, the implementation of MiCA is bringing clarity, albeit with some challenges around consistent application across member states. And in Asia, countries like Hong Kong, Japan, and Singapore are actively shaping their regulatory landscapes to foster innovation and attract investment.

The Importance of Global Consistency

But it's not all sunshine and roses. The report also underscores the importance of global consistency in regulation to prevent regulatory arbitrage. The North Korea's Bybit hack, which led to the exchange losing over USD 1.5 billion in Ethereum tokens, serves as a stark reminder of how illicit actors can exploit unregulated or lightly supervised technologies. This is why international collaboration and real-time information sharing are so critical.

We need to build bridges, not walls, in the digital asset space. We need to foster a global ecosystem where regulators, industry players, and law enforcement agencies work together to combat financial crime and promote responsible innovation. It's a tall order, but I believe it's achievable.

Crypto's Coming of Age

So, what does this all mean? It means that crypto is finally growing up. It's shedding its image as a fringe technology and becoming a legitimate force in the global financial system. It's not going to be a smooth ride, and there will be bumps along the way, but the direction is clear: towards greater regulation, greater transparency, and greater trust. And that, my friends, is something to be excited about. What innovations will emerge from this new era? What new opportunities will be created? I, for one, can't wait to find out.